Earlier this month, the Joint Legislative Audit and Review Committee (JLARC) presented their report on the Dedicated Cannabis Account Appropriations and Expenditures to legislators.

The account was created by Initiative 502, which, when passed, legalized recreational cannabis. The account is primarily funded with excise tax revenue from retail cannabis sales (medical cannabis is exempted from the tax). I-502 did not include funds for cities, towns, or counties but the Legislature added local governments to the Account's statutory funding formula in fiscal year 2018. There are no statutory restrictions on how local governments use the funds.

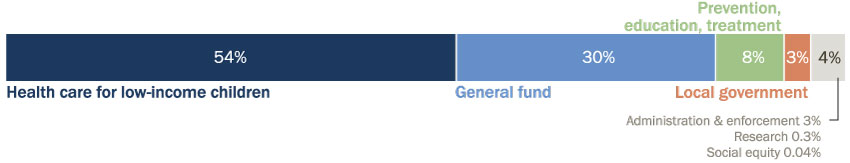

The audit found that state and local agencies spent $3.3 billion from the Dedicated Cannabis Account between fiscal years 2015 and 2023 and that spending was consistent with legislative direction. The state spent $1.8 billion (54% of total) on health care for low-income children. Another 12% was spent on cannabis-specific activities such as market regulation and prevention, education, and treatment. The remaining 34% went to the state general fund and local governments.

The state spent Account funds on health care, cannabis-related activities, and transfers to the general fund and local governments:

Local government disbursements

In fiscal years 2016 and 2017, the Legislature distributed $6 million from the state general fund to local governments for cannabis enforcement.

Local governments were added to the Accounts funding formula in fiscal year 2018 and in fiscal years 2018 through 2021, the total amount distributed to all local governments was capped at $15 million annually, and at $20 million in fiscal year 2022.

In fiscal year 2023, the Legislature simplified the formula and removed the cap. Under the current formula, local governments share 5% of the funds that remain in the Account after the fixed dollar appropriations are made.

- To qualify, the local government must allow cannabis businesses to operate. Cities and towns that allow cannabis businesses are eligible even if they are in a county that does not allow cannabis businesses in unincorporated areas.

- Local governments share 1.5% of funds based on their percent of excise taxes collected.

- Local governments share 3.5% based on their percent of the state population. Counties share 60% of these funds while cities and towns share 40%.

Local government expenditures

A total of 239 cities, towns, and counties have received money from the Account since fiscal year 2018. Each local government decided how to spend its funds. On average, funds from the Account were 0.27% of a local government's general fund revenue.

JLARC staff surveyed the 22 local governments that received over $200,000 in fiscal year 2022. They indicated that they used their funds in the following ways:

- Sixteen used the funds for general government purposes.

- Five used funds to support law enforcement activities.

- Since 2021, King County has used its funds for programs that support individuals affected by past cannabis enforcement laws. Programs included vacating criminal records, community investments, and relief from legal financial obligations (e.g., costs imposed by a court after a criminal conviction).

Learn more