The option of a retail delivery fee—could online shopping mean an end to potholes?

By AWC staff

It should come as no shock to hear that Washington’s cities and towns are dealing with a near-perpetual shortage of funding for the critical maintenance, preservation, and upkeep of roads and other transportation infrastructure. Cities need to be able to continue providing reliable services for existing residents and businesses—including city roads, water and sewer infrastructure, and the vital infrastructure that maintains connectivity between city and state transportation systems.

Most of Washington’s population growth has and will continue to occur in cities, creating greater demands on municipal transportation systems. Cities are also where most businesses operate and most of the state’s tax revenue is produced. According to a report by the U.S. Conference of Mayors, U.S. Metro Economies 2020 GMP and Unemployment Forecast, 94% of gross state product is generated in cities. It’s a wise investment for the state to continue sharing revenues with locals.

About 70% of the funding for city transportation projects comes from cities’ general funds; of that, only 5%, on average, comes from restricted revenues, such as a transportation benefit district. This means transportation needs are pitted against other vital services to residents, like public safety, parks and recreation, and other priorities. In addition, the decline of traditional funding sources like the gas tax exacerbates the funding shortfall for local transportation systems.

In fact, according to the Joint Transportation Commission’s (JTC) recent Statewide Transportation Needs Assessment, “ System maintenance and preservation should be roughly $1 billion more than is currently being spent each year.” The report goes on to say that current spending is only half of what is needed. Decreased distributions from the state and underfunding of Washington’s Transportation Improvement Board for preservation and maintenance have contributed to a large backlog of critical projects. The upswell in city growth and the absence of a stable funding source make it clear that cities lack sufficient fiscal tools for transportation. A reliable, dedicated source of funding is needed.

Why a retail delivery fee?

A retail delivery fee (RDF) is a fee imposed on the purchase of taxable retail items delivered by motor vehicles in the state. Online purchases fall neatly into this category. Generally, the retailer or marketplace facilitator that collects the sales tax on the tangible personal property sold would collect and remit the fee.

An RDF makes sense given that online retail spending in Washington grew at an average annual rate of nearly 17% from 2019 to 2023 and is expected to continue growing. This is higher than the national average of 15%.

Washington’s residential streets weren’t designed to withstand the frequent heavy traffic that comes with the increase of retail delivery vans. Implementing a small retail delivery fee would help pay for the maintenance of city streets.

How much would the fee be, and what are the potential exemptions?

A 2024 research report from JTC examined the potential utility of a retail delivery fee in Washington and provided a wealth of important data, including a look at its use in other states.

Researchers for the JTC considered various scenarios for the fee, including exemptions for small businesses and orders under a $75 threshold. They found that, depending on each scenario, the annual revenue-generating potential of a 30-cent fee (per order) could range from $45 to $112 million in 2026 and $59 to $160 million by 2030.

The annual revenue-generating potential of a 30-cent fee (per order) could range from $45 to $112 million in 2026 and $59 to $160 million by 2030.

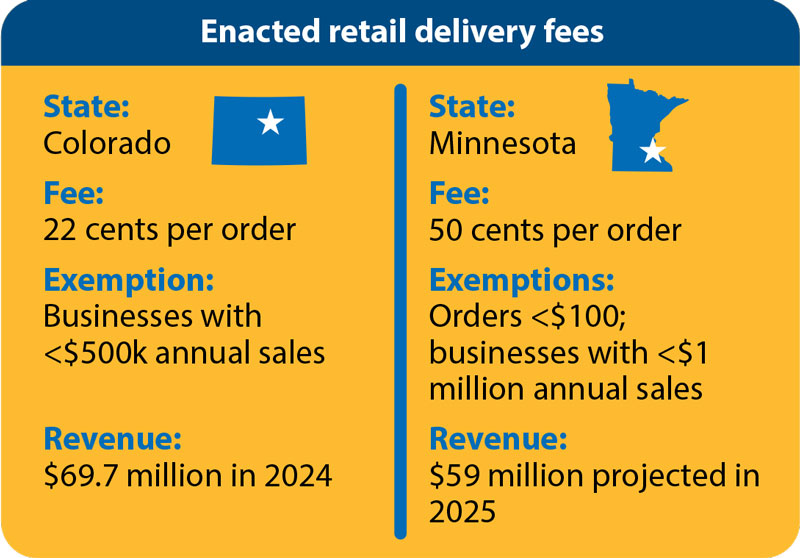

Two states have enacted RDFs: Colorado and Minnesota. Colorado’s fee went into effect July 1, 2022; Minnesota’s took effect July 1, 2024.